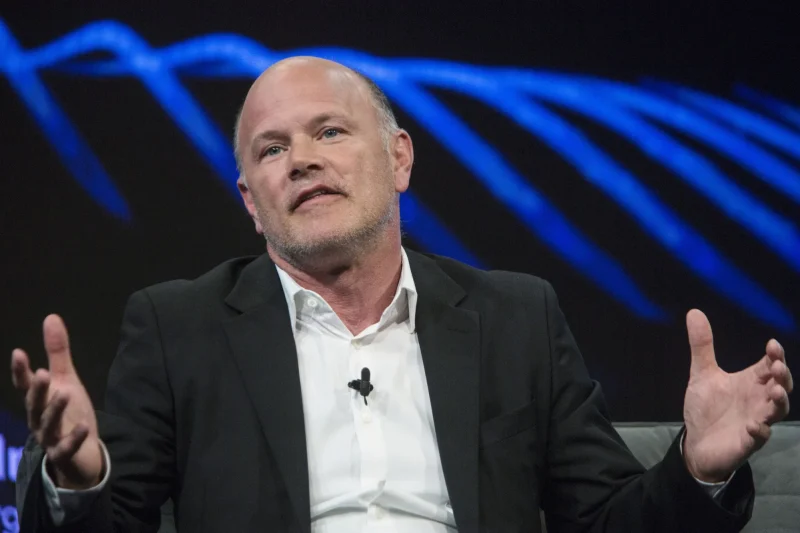

Bitcoin (BTC) is hovering around $109,511 as traders weigh macroeconomic risks. According to Galaxy Digital CEO Mike Novogratz, the biggest bullish spark for Bitcoin could come not from markets but from Washington. He believes that if a highly dovish Federal Reserve chair replaces Jerome Powell, it could push Bitcoin toward $200,000.

Policy Shifts and Crypto Impact

In a recent interview, Novogratz argued that aggressive rate cuts by the next Fed chair could transform the investment landscape. Risk assets such as Bitcoin would likely benefit from looser monetary policy. He described the possibility as “the biggest bull catalyst for Bitcoin and the rest of crypto.”

Novogratz also suggested that this scenario could create a parabolic surge, or what he called a “blow-off top moment.” While this might drive Bitcoin to new highs, he cautioned that the economic consequences could be damaging. Such a policy move could undermine Fed independence and destabilize the broader economy. “It would be really shitty for America,” he warned.

Politics and Market Speculation

Jerome Powell’s term as Fed chair ends in May 2026, which puts President Trump in position to name a successor. Candidates reportedly under consideration include Kevin Hassett, Christopher Waller, and Kevin Warsh. Analysts such as Daleep Singh of PGIM note that political influence could push the central bank toward a more dovish approach after Powell’s departure.

For now, investors appear to be waiting on clarity. Novogratz cautioned that markets may not react until Trump makes a final decision. “I don’t think the market will buy that Trump’s going to do the crazy, until he does the crazy,” he said.

If Novogratz’s outlook proves correct, Bitcoin could see a euphoric rally that breaks well beyond $200,000. However, this comes with trade-offs: higher inflation risks, weaker central bank credibility, and potential financial instability.

For crypto investors, the Fed chair decision is more than a political event—it could set the tone for digital assets and risk markets for years. While expectations may drive short-term moves, the real test lies in how policy unfolds once the new chair takes office.